An economic recovery is the phase of the business cycle following a recession, during which an economy regains and exceeds peak employment and output levels achieved prior to downturn. A recovery period is typically characterized by abnormally high levels of growth in real gross domestic product, employment, corporate profits, and other indicators. - Wikipedia.

A early expansionary phase of the business cycle shortly after a contraction has ended, but before a full-blown expansion begins. During a recovery, the unemployment rate remains relatively high, but it is beginning to fall. Real gross domestic product has begun to increase, usually rapidly. However, because the contraction remains fresh in the minds of many, it may not be immediately clear that the trough of the contraction has been reached. - Economic Glossary.

Phase in an economic cycle where employment and output begin to rise to their normal levels after a recession or slump. - Business Dictionary.

A period of increasing business activity signaling the end of a recession. Much like a recession, an economic recovery is not always easy to recognize until at least several months after it has begun. Economists use a variety of indicators, including GDP, inflation, financial markets and unemployment to analyze the state of the economy and determine whether a recovery is in progress. - Investopedia.

So let's take a brief look at some of the relevant quantities: GDP, unemployment and inflation.

| source: UK Public Spending |

|

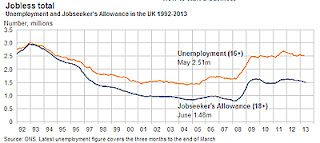

| Source: BBC |

|

| Source: BBC |

On the bright side, and I'm sure the government see this as a positive, driving wages down ought to help with the unemployment figures in theory. Lower wages means that firms are more likely to take on new staff. Unfortunately with demand stagnant there is no real potential for expansion in the economy as a whole.

These are broad brush-stroke figures. Not the kind of detailed info that professional economic pundits use. That said I do not see a recovery here. I see stagnation. It might be argued that I expect to see stagnation because of the economists who influence my thinking. But if someone else can see a recovery in these figures then I'd be interested to know how.

No comments:

Post a Comment

Keep is seemly & on-topic. Thanks.